epf withdrawal i sinar

Over the past two years the government rolled out three EPF withdrawal schemes i-Sinar i-Lestari and i-Citra in addition to a fourth special withdrawal in March this year. For those who have.

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Nestia

More than 8 million members will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i-Sinar programme.

. How much can you withdraw from EPF i-Sinar. For further information members may contact the i-Sinar hotline at 03-8922 4848. Despite the convenience offered the facility is not a withdrawal or a form of free cash because EPF.

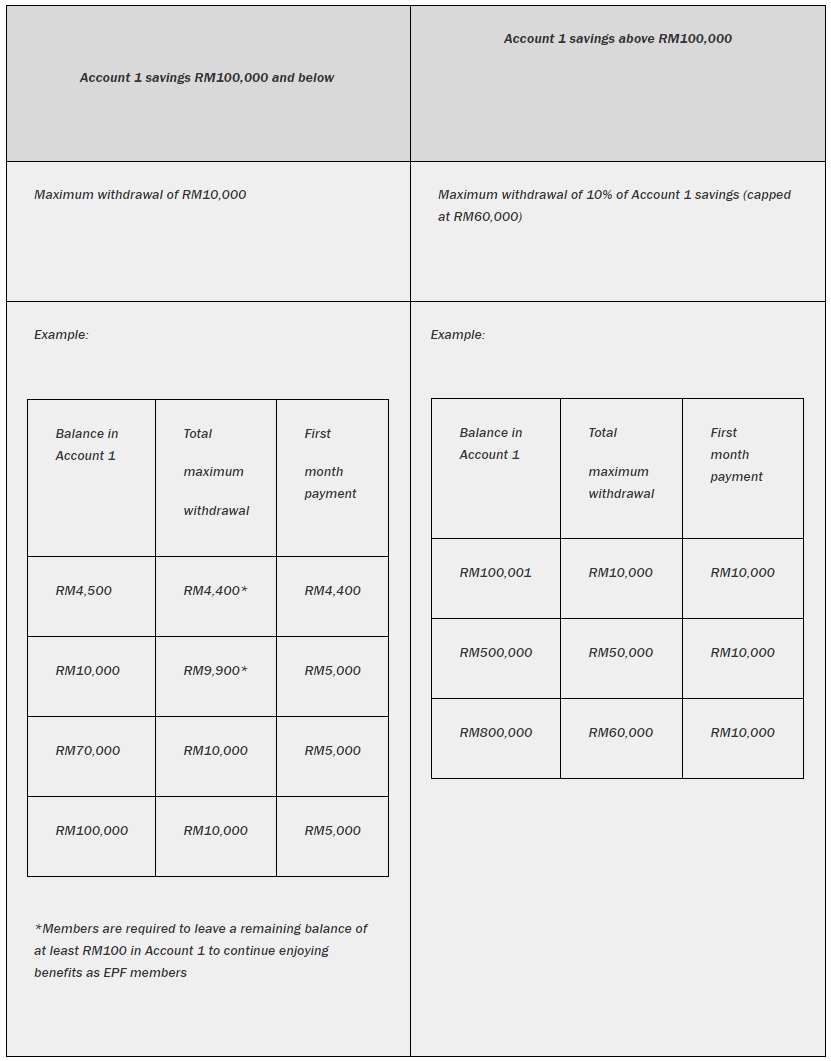

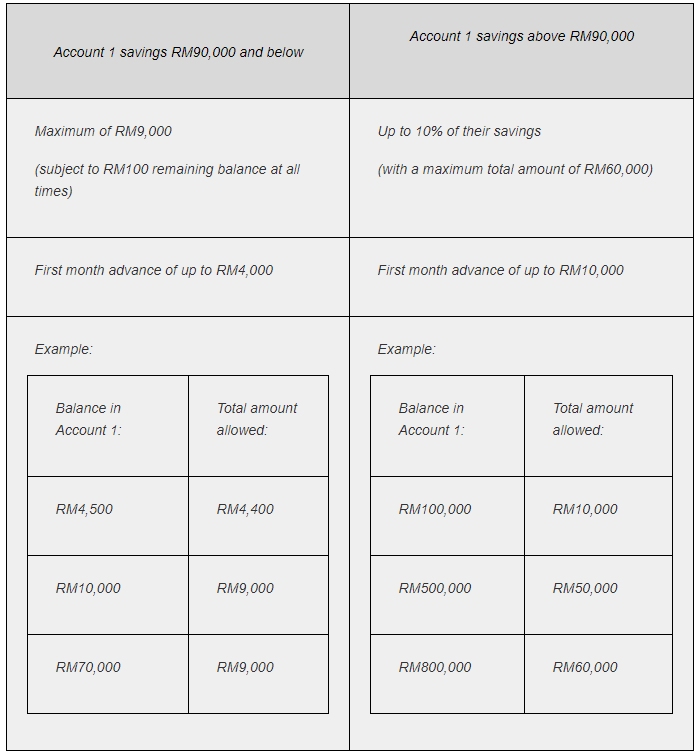

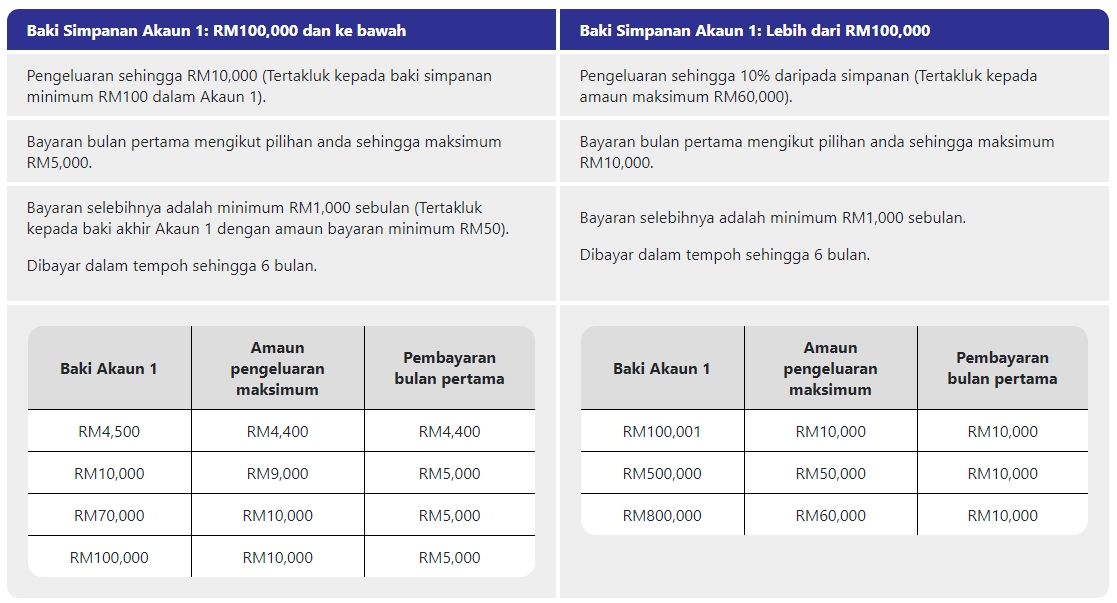

The idea is that this will help those who have been impacted by the prolonged pandemic to make ends meet. The actual amount that you can withdraw under the i-Sinar facility depends on whether you have more or below than RM100000 savings in your Account 1. EPF mmembers can mafe the withdrawal at httpspengeluarankhaskwspgovmy through the i-Account starting 1 April.

For those with they can withdraw any amount up to RM10000. In general the withdrawal will add liquidity to the countrys economy and this should give a boost to economic activities as Malaysians have a high tendency to spend Yesterday the EPF said it expects the i-Sinar facility to benefit two million eligible members with an estimated advance amount of RM14 billion to be made available. They have to withdraw from the savings balance in their Account 2 before accessing the savings in Account 1.

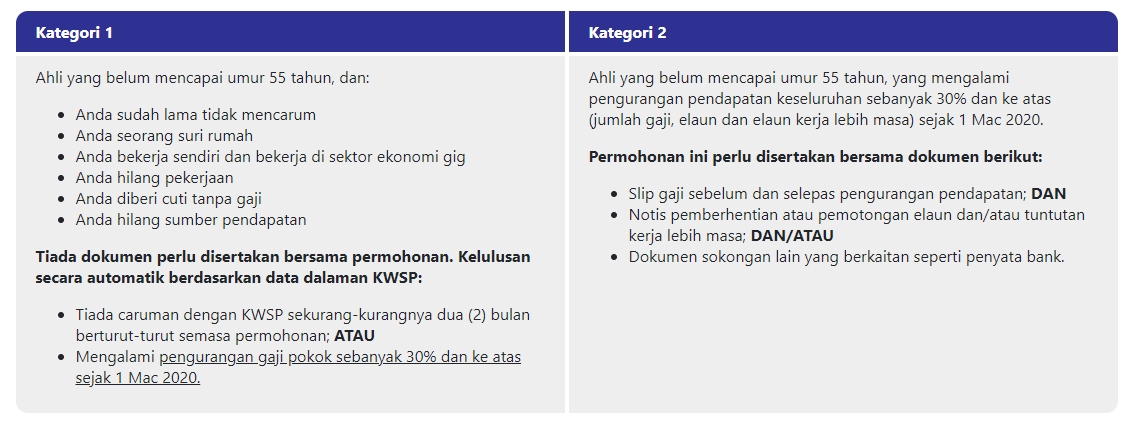

The change will see all EPF members below the age of 55 able to make withdrawals from their Akaun 1 subject to their remaining account balance. Tengku Zafrul said the removal of conditions will allow EPF members under the age of 55 to withdraw from their Account 1 funds subject to their existing balance. The Employees Provident Fund EPF has revealed full details for the i-Sinar program which will allow eligible members to make withdrawals from Account 1.

According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December. For members who have already applied for i-Sinar under the current criteria their applications will be automatically approved in due course he said.

This was done via the i-Lestari i-Sinar and i-Citra schemes which resulted in a total withdrawal of RM 101 billion by 74 million members. Through the facility which expects to benefit half of its 14 million contributors members can withdraw up to RM60000 from their account one. The payments will be staggered over a period of six 6 months with the first payment of up to RM10000.

The move will benefit some eight million EPF contributors Finance Minister Tengku Zafrul Aziz said in the Dewan Rakyat today. For those with more than RM100000 may withdraw up to 10 of their account balance with a. Members who have applied for i-Sinar based on the current criteria will have their applications automatically approved shortly the finance ministers statement read.

EPF members are allowed to withdraw a maximum amount of RM10000 and a minimum of RM50. The i-Sinar program was introduced to assist members who are affected by the current pandemic situation. You can choose how much to withdraw in the first payout but the subsequent payments must be at least RM1000 per month.

From this average we can estimate the monthly EPF contribution will amount to RM71400 based on members contribution at 9 and employers contribution at 13. Payments will be staggered over a maximum period of six 6 months with the first payment of up to RM5000. A Account 1 savings RM100000.

For members that have RM100000 or less in Account 1 you are only allowed to withdraw up to RM10000. The government has announced an extension of its i-Sinar programme to allow all Malaysians to withdraw funds from Account 1 of the Employees Provident Fund EPF. Taking this average wage-earner as an example heres an estimate of how much can be saved for retirement in the next 20 years.

Jun 7 2021 1020 AM updated 2w. For members who fulfil the criteria their application will be approved automaticallyOnly confirmation of the maximum amount is required during members online application and is not difficult. The eligible amount for i-Sinar is subject to the members Account 1 balance based on the latest details below.

EPF full withdrawal I Sinar 20 Bantu rakyat dengan duit rakyat. However it is important to note that this is not a withdrawal. 1Withdraw 20k i-sinar 2Follow TS stock purchase recommendation 3Bursa open all in 4Google search top 10 places to 14th floor.

It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021. But what was once hailed as a lifeline may also have contributed to the increase in price of goods that has left millions feeling the pinch today. Applications start from 21 Dec 2020.

However the maximum total amount withdrawal allowed is RM60000. 1 According to EPF this has resulted in 61 million members having less than RM 10000 currently in their savings and a staggering 79 of them having less than RM 1000 left consequently. The process of verification is required to avoid fraud and improper withdrawal of i-Sinar funds by third parties.

I Sinar 8 Other Things You Can Use Your Epf For

I Sinar Withdrawal A Case Of Desperate Times Calling For Desperate Measures Now And Also In The Future Businesstoday

Why I Sinar Went Wrong And Why Epf Contributors Shouldn T Be Treated Like White Knights Consumers Association Penang

Here S How You Can Get Access To Your Epf Account 1 Hr News

Epf Account 1 Withdrawal I Sinar The Pros And Cons

Kwsp I Sinar The Vibes Malaysia Epf To Announce Otosection

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf Approves Rm19 62 Billion Worth I Sinar Applications Businesstoday

I Sinar Category 2 How To Apply And Eligibility Comparehero

Epf Allows Eligible Members To Get Up To 10 From Account 1 With I Sinar Hype Malaysia

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf Announces Latest Details For Its I Sinar Withdrawal Facility

Bernama Epf Offers Further Details On I Sinar In Response To Media Query

The State Of The Nation Rm90 Bil I Sinar Withdrawal Changes Odds Of 5 Epf 2021 Dividend The Edge Markets

I Sinar Category 2 How To Apply And Eligibility Comparehero

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf Account 1 Withdrawal I Sinar The Pros And Cons

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Comments

Post a Comment